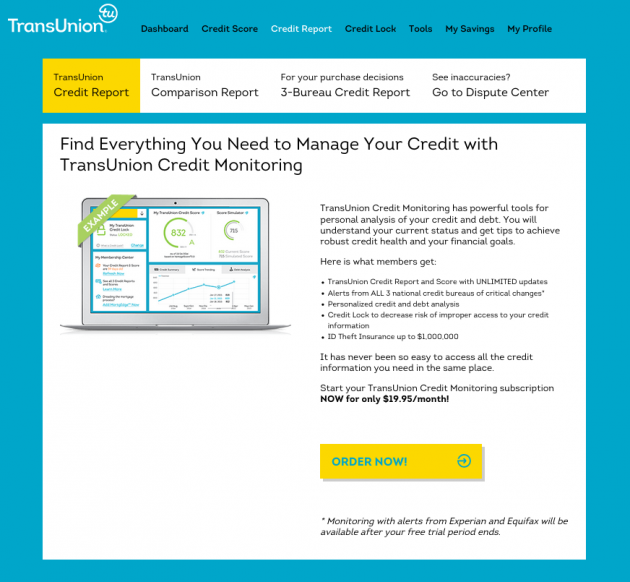

The two biggest advantages of a lock are the ease with which you can lock and unlock your report at transunion it can happen instantly on an app and in some states the cost you need to pay a.

Locking your credit report transunion.

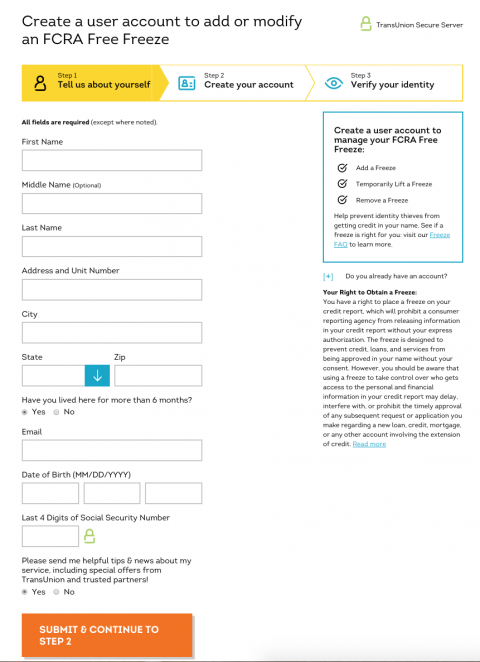

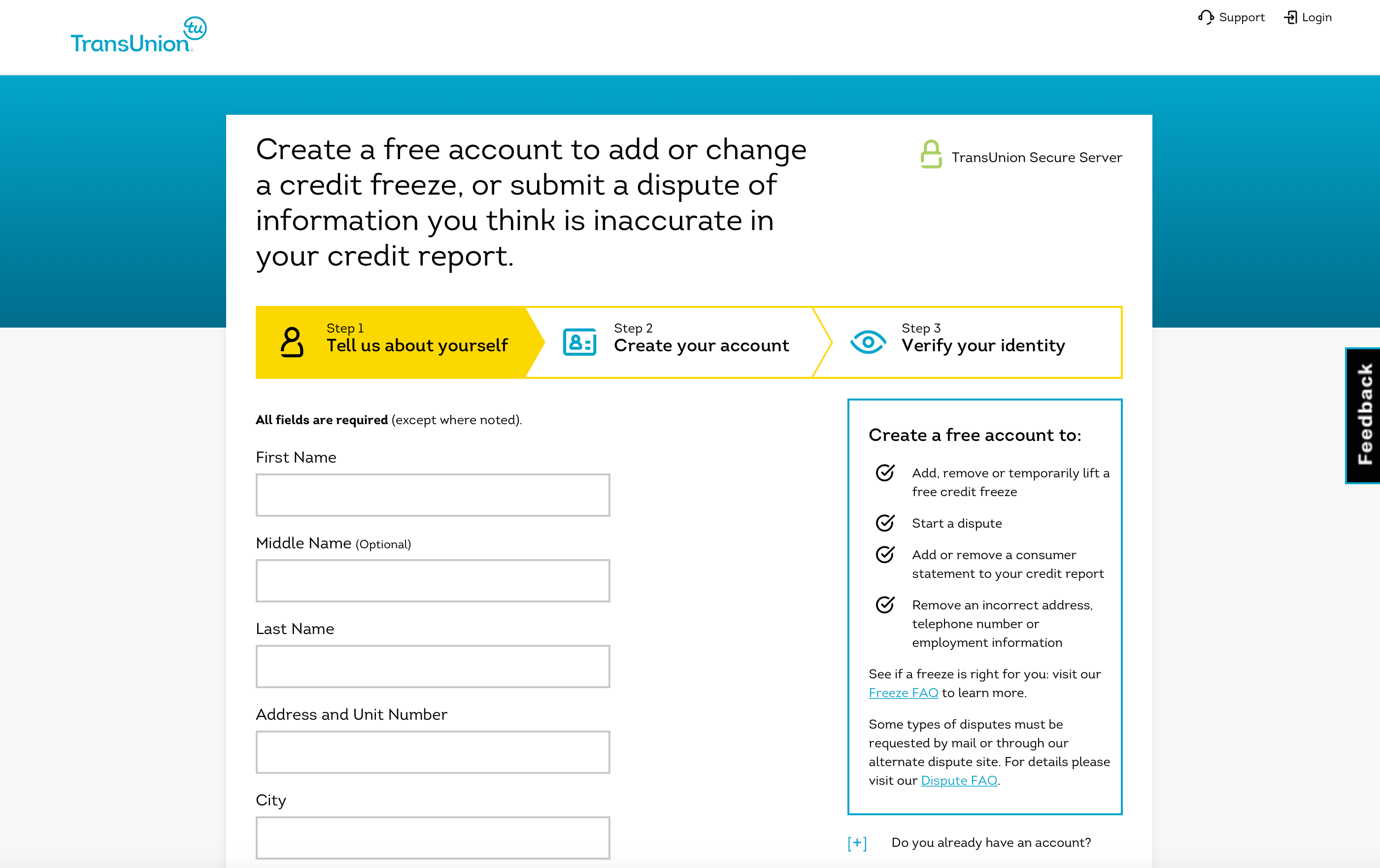

What is a credit freeze.

There are various types of credit scores and lenders use a variety of different types of credit scores to.

How to lock your credit report at experian.

You can then click lock now to lock your equifax credit report.

You will need to remove the security freeze in order to lock your equifax credit report.

A credit lock also known as a security lock has the same result as a credit freeze but it s easier and quicker to lock and unlock your credit than to freeze and un freeze or thaw it.

Locking your credit is a procedure that can help prevent identity theft and credit fraud by blocking access to your credit report.

Accessing your credit report is an important part of managing your credit health through the covid 19 outbreak.

It costs 4 99 the first month and 24.

Get your credit score get your credit report score.

If you want to apply for new credit or a new employer or landlord needs to run your credit you can temporarily unlock your credit report just as easily.

When you freeze your credit report creditors and lenders can t pull your credit report or credit score the numeric value given to your credit report unless you ve provided the credit bureau a password to unlock your credit report.

How to freeze your credit report with all three bureaus.

Experian s program creditlock is offered as part of a larger service experian creditworks sm premium.

Since most banks require a credit check an application for credit would likely be denied.

What you need to know.

Also known as a security freeze this free tool lets you restrict access to your credit report which in turn makes it more difficult for identity thieves to open new accounts in your name.

On your dashboard expand the single bureau lock feature in the list on the right.

With credit lock plus you are in control of your credit reports at transunion and equifax.

That s because most creditors need to see your credit report before they approve a new account.

For many people carefully monitoring their credit report and account statements for any unauthorized activity is enough.

For others with data breaches being such a regular occurrence there s tremendous value and peace of mind with an extra level of identity and credit protection with locking or freezing your credit file.

We ve also included the appropriate link for each bureau.

Pros and cons of freezing your.